Use Your Calculator To Find The Ytm On A 20 Year

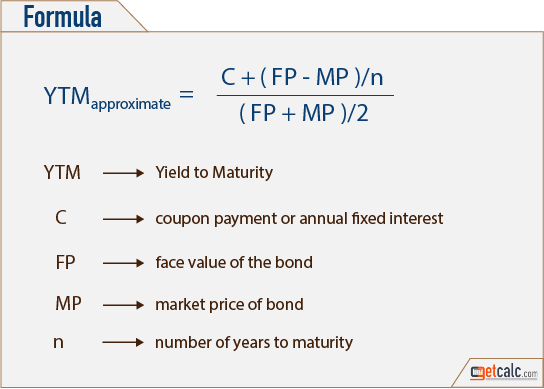

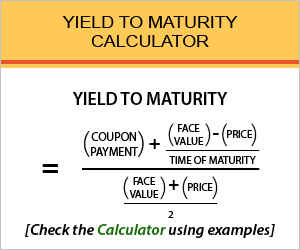

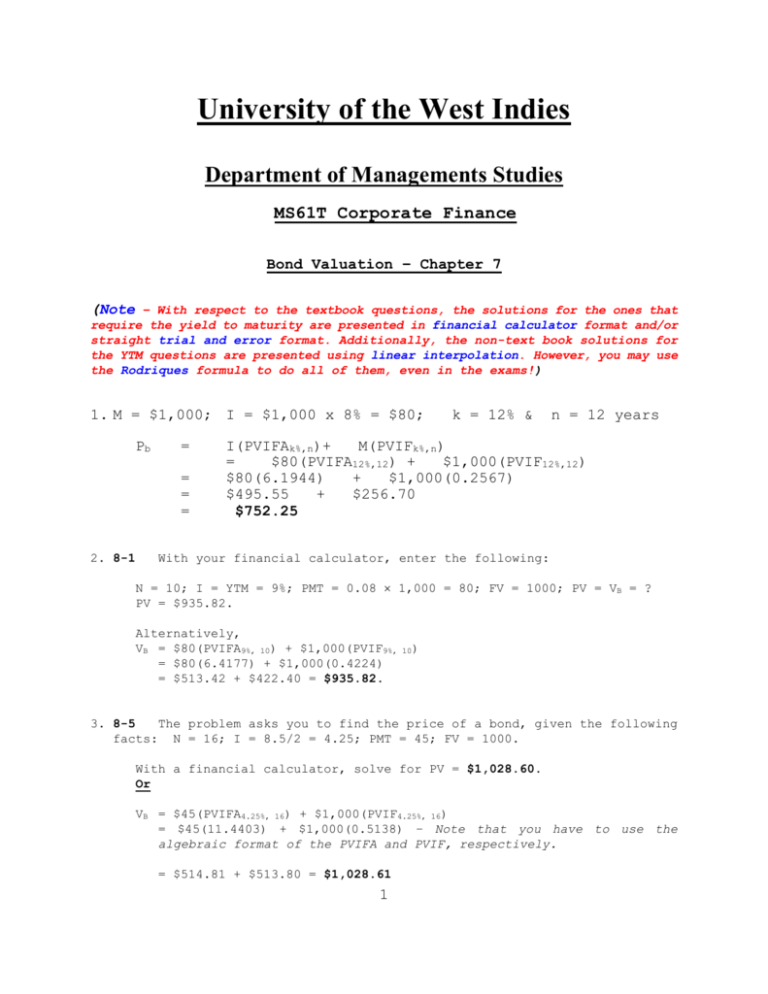

To apply the yield to maturity formula we need to define the face value bond price and years to maturity. Yield to Maturity Formula YTM dfrac C dfracF-Pn dfracFP2 C Couponinterest payment.

Trigonometry With Your Calculator.

:max_bytes(150000):strip_icc()/dotdash_Final_Duration_Aug_2020-02-a79edb63b9264dc9a76ee587240a27ea.jpg)

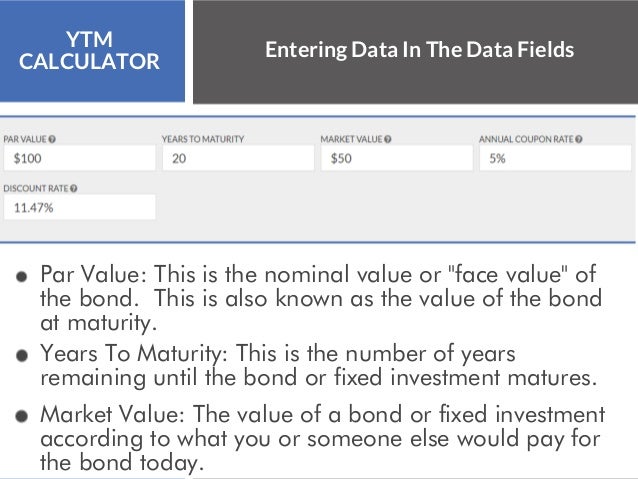

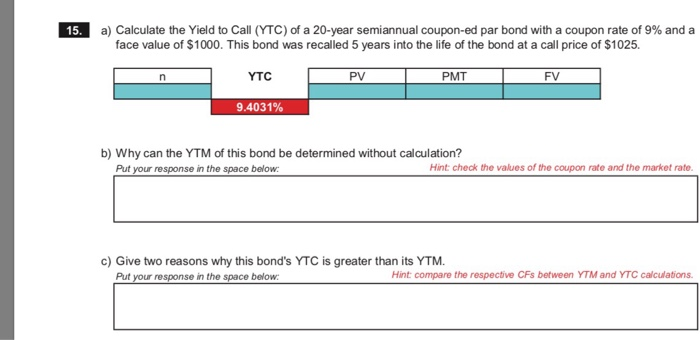

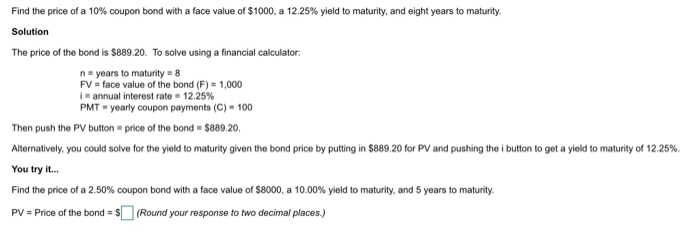

Use your calculator to find the ytm on a 20 year. This YTM calculator assumes that the bond is. N Years to maturity. Calculate the yield to maturity for this bond using the time value of money keys on a financial calculator and solving for the interest rate I of 3507.

Importantly it assumes all payments and coupons are on time no defaults. Bond Yield to Maturity YTM Calculator. Historical 30-YR Mortgage Rates.

Use the correct number of significant digits. On this page is a bond yield to maturity calculator to automatically calculate the internal rate of return IRR earned on a certain bond. On this page is a bond yield to call calculator.

To calculate a bonds maturity YTM its vital to understand how bonds are priced by combining the present value of all future interest payments cash flows with the repayment of the. To calculate the approximate yield to maturity you need to know the coupon payment the face value of the bond the price paid for the bond and the number of years to maturity. 5 1 Ratings Solved.

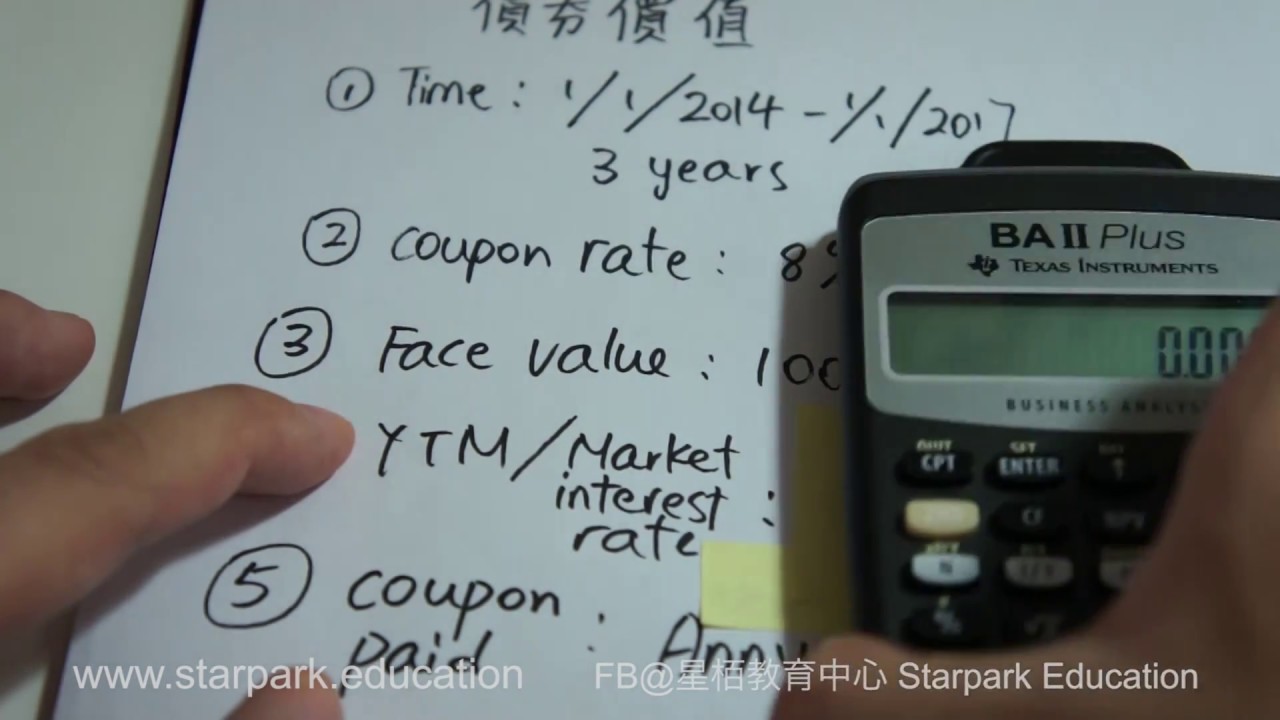

View Using a financial calculator to find YTMpptx from ECONOMICS 101 at University of Santo Tomas. Finance 1 Year Ago 21 Views. A brief demonstration on calculating the price of a bond and its YTM on a financial calculator.

The formula for determining approximate YTM would look like below. The bond pays interest twice a year and matures in 5 years. This straight-line amortized value gets used each year to determine the estimated sale value of the bond each year from which to calculate an estimated yield and net present value in a given year.

This calculator automatically assumes an investor holds to maturity reinvests coupons and all payments and coupons will be paid on time. Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder based on the face value of the bond. Its difficult to calculate the exact YTM but in the formulas below well look at how you can calculate the approximate yield to maturity of a bond.

Show which values go in financial calculator. Question Calculate the YTM using excel formula and cells. 1000 as the face value 8 as the annual coupon rate 5 as the years to maturity 2 as the coupon payments per year and 900 as the current bond price.

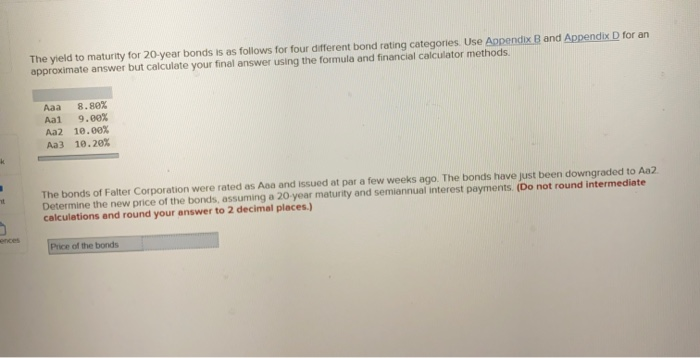

20-year mortgages tend to be priced at roughly 025 to 05 lower than 30-year mortgages. Solved Expert Answer to Calculate the YTM on a 20 year 8 coupon bond that is selling for 1180 and the par value is 1000. Yield to Maturity YTM CF-PnFP2 where C Bond Coupon Rate F Bond Par Value P Current Bond Price n Years to Maturity.

F Face value. This Question has Been Answered. The straight-line amortized value is the difference between the market value and the par value each year multiplied by the year and then divided by the years left to maturity.

How to Calculate Yield to Maturity. In this case the interest rate is the semi-annual rate and can be multiplied by two for an annual rate of 701. The calculator uses the following formula to calculate the yield to maturity.

P C1 r-1 C1 r-2. A sin 042 b cos. These figures are plugged into the formula A p p r o x Y T M.

Calculate the YTM on a 20 year 8 coupon bond that is selling for 1180 and the par value is 1000. This can be done by just changing the years to maturity value. The interest is 8 percent and it will mature in 12 years we will plugin.

Finding trig ratios and angles using your calculator. For example if you purchased a 1000 for 900. What is the YTM on a 10-year 9 annual coupon 1000 par value bond selling for 887.

A cos 36918 b tan 42662 c sin 466 d cot 179 Determine in degrees. Show which values go in financial cal. Straight Line Amortized Value.

The obtained value of yield to maturity from the calculator is useful in determining if buying a bond is a good investment. P is the price of a bond C is the periodic coupon payment r is the yield to maturity YTM of a bond B is the par value or face value of a bond Y is the number of years. It automatically calculates the internal rate of return IRR earned on a callable bond assuming its called at the first possible time.

You can use the following calculators to compare 20 year mortgages side-by-side against 10-year 15-year and 30-year options. Use the correct number of significant digits. For the bond is 15 and the bond will reach maturity in 7 years.

Use a calculator to find the function value. The calculator shows you the results as an annual percentage so you can use the calculator for estimating YTM for bonds with different maturity periods. Settlement date D7 Maturity date D8 Annual coupon rate D9.

C1 r-Y B1 r-Y. The following table lists historical average annual mortgage rates for conforming 30-year mortgages.

16a In The Previous Section Of This Problem Set Chegg Com

How To Calculate Bond Price With Ytm

Yield To Maturity Calculator Ytm Calculator

Yield To Maturity Calculator Find Formula Check Example More

15 A Calculate The Yield To Call Ytc Of A 20 Year Chegg Com

Learn To Calculate Yield To Maturity In Ms Excel

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Find The Price Of A 10 Coupon Bond With A Face Value Chegg Com

How To Calculate Yield To Maturity Definition Equation Example Video Lesson Transcript Study Com

How To Calculate Yield To Maturity Definition Equation Example Video Lesson Transcript Study Com

The Yield To Maturity For 20 Year Bonds Is As Follows Chegg Com

Finding Ytm By Using Financial Calculator Edit Youtube

How To Calculate Yield To Maturity Definition Equation Example Video Lesson Transcript Study Com

Https Skb Skku Edu Summer Board Academic Do Mode Download Articleno 28393 Attachno 15523

Solving For A Bond S Yield To Maturity With Semiannual Interest Payments Youtube

Learn To Calculate Yield To Maturity In Ms Excel

How Do I Calculate Yield To Maturity Ytm With A Simple Handheld Calculator For Semiannual Payments Personal Finance Money Stack Exchange

How To Calculate Yield To Maturity Definition Equation Example Video Lesson Transcript Study Com

Post a Comment for "Use Your Calculator To Find The Ytm On A 20 Year"